March 8, 2017: Preliminary unaudited results for the fiscal year 2016 and announcement of term loan repricing

Wiedenzhausen, Germany, March 8, 2017 – Wittur International Holding GmbH (ISIN: XS1188024548, XS1188025438) (“Wittur” and, together with its subsidiaries, the “Wittur Group”), one of the world’s leading independent elevator components manufacturers, announced today certain preliminary estimated unaudited financial information for the fiscal year ended December 31, 2016. Investors are cautioned that these estimates are preliminary in nature and based only upon information available to the company as of the date of this press release. The company has not yet completed its financial closing procedures for the fiscal year ended December 31, 2016, and these estimates have not been audited or verified by the company’s independent auditors. Accordingly, such preliminary financial data may change, and such changes may be material. Therefore, investors are cautioned not to place undue reliance on these estimates. The company expects that Wittur's audited financial statements as of and for the fiscal year ended December 31, 2016 will be released on or about April 28, 2017.

Fiscal Year 2016 Preliminary Results

Wittur estimates that on an actual basis (including the Sematic Group’s contribution as of April 1, 2016) for the fiscal year ended December 31, 2016:

- Consolidated revenues will be approximately EUR 698 million. This represents an increase of 18%, compared to the Wittur Group’s pro forma revenues of EUR 590 million for the fiscal year ended December 31, 2015 (with results adjusted to give pro forma effect to the Bain Acquisition, as if such acquisition had occurred on January 1, 2015). The increase in revenues was primarily driven by the contribution of the Sematic Group and strong performance in Europe.

- Consolidated EBITDA Adjusted will be approximately EUR 97 million. This represents an increase of 13%, compared to the Wittur Group’s pro forma EBITDA Adjusted for the fiscal year ended December 31, 2015 (with results adjusted to give pro forma effect to the Bain Acquisition, as if such acquisition had occurred on January 1, 2015). The improved performance was due to the contribution of the Sematic Group, as well as further realization of synergies, and was partially offset by negative exchange rate effects.

Wittur estimates that on a stand-alone basis (excluding the Sematic Group’s contribution) for the fiscal year ended December 31, 2016:

- Consolidated revenues would be approximately EUR 582 million, with solid revenue growth in Europe, but a slightly weaker performance in Asia, primarily driven by exchange rate effects. At constant exchange rates, revenues would be approximately 3% higher than in the prior year.

- Consolidated EBITDA Adjusted would be approximately EUR 85 million.

Fourth Quarter 2016 Results

Wittur estimates that on an actual basis (including the Sematic Group’s contribution) for the three months ended December 31, 2016:

- Consolidated revenues will be approximately EUR 187 million, representing an increase of 29%, compared to the Wittur Group’s revenues of EUR 146 million for the three months ended December 31, 2015.

- Consolidated EBITDA Adjusted will be approximately EUR 22 million, which represents an increase of 14%, compared to EUR 19 million for the three months ended December 31, 2015.

Wittur estimates that on a stand-alone basis (excluding the Sematic Group’s contribution) for the three months ended December 31, 2016, revenues would be approximately EUR 148 million.

Term loan repricing

Wittur Group today announced the launch of a repricing of its existing €410m term loan. In connection with this repricing, Wittur Group is considering to slightly upsize the term loan to partially repay borrowings under its revolving credit facility. This will free up Wittur’s revolving credit facility, which was used among others to finance the acquisition of Sematic and related integration costs, to be used for its main purpose of financing ordinary business transactions and working capital.

About Wittur

Founded in 1968, Wittur is one of the world’s leading independent elevator components manufacturers with an extensive global manufacturing footprint and sales network and a broad range of products. Its product offering features a large range of components for new elevator manufacturing and sourcing, for spare parts and for modernization and upgrades. Components made by Wittur span from sophisticated mechatronic components for elevator cabin and landing doors (including the associated opening mechanisms) to other critical components such as gearless drives, slings, safety gears and cars.

Wittur was indirectly acquired by Wittur International Holding GmbH (formerly Paternoster Holding III GmbH) on March 31, 2015 (the “Bain Acquisition”). On April 1, 2016, Wittur further expanded its global reach and its portfolio with the acquisition of the Sematic Group (the “Sematic Acquisition”). Sematic S.p.A. and its subsidiaries (together, the “Sematic Group”), an Italian group founded in 1959, added a complementary product offering including complete elevator solutions, highly customised doors, electronic components and cabins. The Wittur Group has a work force of around 4,400 employees and conducts business in more than 50 countries. It is majority-owned by funds managed by Bain Capital.

For more information on the company, please visit www.wittur.com.

Forward-Looking Statements

This press release contains statements relating to estimates and future results (including certain preliminary results, projections and business trends) that are forward-looking statements within the meaning of the securities laws of certain applicable jurisdictions. In particular, the company has provided approximate estimates, rather than definitive amounts, for the preliminary results described above primarily because its financial closing procedures for the year ended December 31, 2016 are not yet complete. These forward-looking statements include, but are not limited to, all statements other than statements of historical facts contained in this press release, including, without limitation, those regarding our future financial position and results of operations, our strategy, plans, objectives, goals and targets, future developments in the markets in which we participate or are seeking to participate or anticipated regulatory changes in the markets in which we operate or intend to operate. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “plan,” “potential,” “predict,” “projected,” “should,” or “will” or the negative of such terms or other comparable terminology. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and are based on numerous assumptions and that our actual results of operations, including our financial condition and liquidity and the development of the industry in which we operate, may differ materially from (and be more negative than) those made in, or suggested by, the forward-looking statements contained in this press release. In addition, even if our results of operations, including our financial condition and liquidity and the development of the industry in which we operate, are consistent with the forward-looking statements contained in this press release, those results or developments may not be indicative of results or developments in subsequent periods. Important risks, uncertainties and other factors that could cause these differences include, but are not limited to the risks described in the financial reports provided on our website. In light of these risks, uncertainties and assumptions, the forward-looking events described in this press release may not be accurate or occur at all. Accordingly, investors should not place undue reliance on these forward-looking statements, which speak only as of the date on which the statements were made. We undertake no obligation, and do not intend, to update or revise any forward-looking statement or risk factors, whether as a result of new information, future events or developments or otherwise. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements referred to above and contained elsewhere in this press release.

Non-GAAP Financial Measures

EBITDA Adjusted, pro forma revenue and revenue at constant currency represent non-GAAP financial measures (the “non-GAAP measures”) that are not required by, or presented in accordance with, IFRS or any other generally accepted accounting principles. We present the non-GAAP measures because we believe that they and similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance and liquidity. The non-GAAP measures may not be comparable to other similarly titled measures of other companies. The non-GAAP measures have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results or any performance measures under IFRS as set forth in our financial statements. You should compensate for these limitations by relying primarily on our financial statements and using these non-GAAP measures only on a supplemental basis to evaluate our performance.

Investor Relations Contact

Yara Kes

Wittur Holding GmbH

Rohrbachstraße 26-30

85259 Wiedenzhausen | Germany

Phone: +49(81 34) 18 - 173

Mail: yara.kes@wittur.com

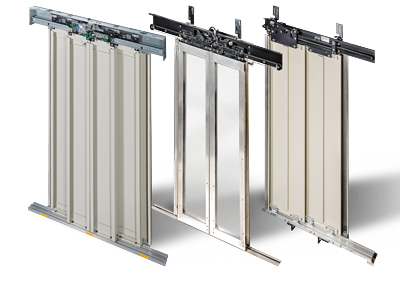

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors. Since 1977 Wittur has been providing the lift industry with versatile and high-quality doors. More than 30 years later Wittur is the leading company in the lift doors segment, with state-of-the-art technical solutions and unparalleled product range. Regardless of whatever your lift requires - a round door with panoramic panels rather than a straight or a folding one - Wittur can supply the best solution for your needs.

Since 1977 Wittur has been providing the lift industry with versatile and high-quality doors. More than 30 years later Wittur is the leading company in the lift doors segment, with state-of-the-art technical solutions and unparalleled product range. Regardless of whatever your lift requires - a round door with panoramic panels rather than a straight or a folding one - Wittur can supply the best solution for your needs. Research for innovative solutions and rigid control of product quality are key features of Wittur Safeties.

Research for innovative solutions and rigid control of product quality are key features of Wittur Safeties.  Wittur offers a wide range of car and counterweight frames. Modularly conceived, these components are very flexible in terms of rated load, height and width. The wide range of accessories includes safety gears, suspension pulleys, compensation chain and travelling cable hangers, allowing configurations suitable for different shaft layouts, lift designs and rated speeds. Wittur can also supply special frames for tailored projects.

Wittur offers a wide range of car and counterweight frames. Modularly conceived, these components are very flexible in terms of rated load, height and width. The wide range of accessories includes safety gears, suspension pulleys, compensation chain and travelling cable hangers, allowing configurations suitable for different shaft layouts, lift designs and rated speeds. Wittur can also supply special frames for tailored projects.

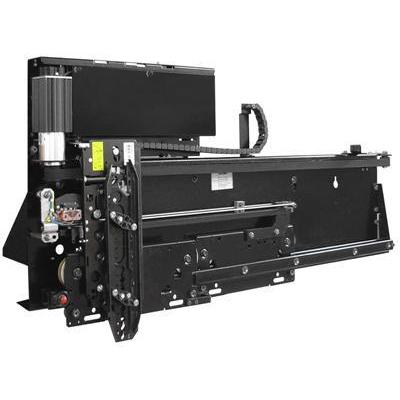

Research for innovative solutions and rigid product quality control are key features of Wittur Safeties.

Research for innovative solutions and rigid product quality control are key features of Wittur Safeties. According to EN81-1/2 A3 and EN81-21 A1 (new lifts in existing buildings), new lifts installed after January 1st 2012 must be equipped with a system to prevent a car moving away from the floor with the landing door not in the locked position and the car door not in the closed position.

According to EN81-1/2 A3 and EN81-21 A1 (new lifts in existing buildings), new lifts installed after January 1st 2012 must be equipped with a system to prevent a car moving away from the floor with the landing door not in the locked position and the car door not in the closed position.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors..jpg) Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors. Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.