Quarterly Key figures

| Wittur Group Consolidated | Wittur Group Consolidated | ||||

| 9M 2017 | 9M 2018 | Change | |||

| Revenue1) | EUR m | 588,2 | 601,7 | 2,3% | |

| by region | |||||

| Europe | EUR m | 317,5 | 321,8 | 1,3% | |

| Asia | EUR m | 217,7 | 232,4 | 6,8% | |

| Rest of World | EUR m | 53,0 | 47,6 | -10,3% | |

| Revenue growth at constant currency2) | % | n/a | 6,2% | ||

| Gross profit before depreciation3), 14) | EUR m | 146,3 | 149,5 | 2,2% | |

| EBITDA Adjusted4), 14) | EUR m | 82,8 | 94,0 | 13,5% | |

| EBITDA Adjusted4) margin | % | 14,1% | 15,6% | 1,5% | |

| EBIT5), 14) | EUR m | 20,7 | 46,2 | 123,6% | |

| EBIT5) margin | % | 3,5% | 7,7% | 4,2% | |

| Profit or loss for the period6), 14) | EUR m | -6,6 | 0,1 | -101,4% | |

| Net cash flow used in investing activities7) | EUR m | -8,7 | -6,6 | -24,0% | |

| Net cash flow before financing activities8), 14) | EUR m | 54,4 | 58,6 | 7,8% | |

| Number of doors9) | number | 1.494.390 | 1.514.456 | 1,3% | |

| Employees10) | number | 4.482 | 4.620 | 3,1% | |

| 31.12.2017 | 30.09.2018 | Change | |||

| Total equity and liabilities14) | EUR m | 1.026,5 | 997,2 | -2,9% | |

| Equity14) | EUR m | -34,6 | -45,3 | 31,1% | |

| Equity ratio | % | -3,4% | -4,5% | -1,2% | |

| Wittur Group Net Financial Debt11), 14) | EUR m | 636,5 | 646,0 | 1,5% | |

| Wittur Group LTM EBITDA Adjusted12), 14) | EUR m | 106,7 | 119,1 | 11,6% | |

| Ratio of Net Financial Debt to LTM EBITDA Adjusted13) | ratio | 5,97x | 5,43x | -0,54x | |

| 1) | Revenue: generated from the manufacture and provision of components, drives and systems for the elevator industry. This includes elevator components, such as automatic elevator doors, cabins, safety components, drives, elevator frames and complete elevators, used both in new installations and modernizations. | |

| 2) | Revenue growth excluding exchange rate effects. | |

| 3) | Gross profit before depreciation: revenue less cost of sales which includes direct and indirect production costs attributable to the production process and relating to the products sold, including costs of materials, labor, freight, packaging and other costs, as well as income and costs resulting from changes in warranty provisions. Cost of sales excludes personnel costs for employees in research and development, selling and distribution and general and administration functions. | |

| 4) | EBITDA Adjusted: consolidated net result for the period adding back finance expense, finance income, income taxes and depreciation and amortization after adjusting for extraordinary income and expenses. For information on the early adoption of IFRS 16 Leases, please refer to Section “Accounting Policies” in the Nine-Month Financial Report as of September 30, 2018. |

|

| 5) | EBIT: Consolidated net result for the period adding back finance expense, finance income and income taxes. | |

| 6) | Profit or loss for the period: consolidated net result for the period. | |

| 7) | Net cash flow used in investing activities: net cash flow from investing activities less purchase/sale of other investments less other investing cash flow. | |

| 8) | Net cash flow before financing activities: net cash flow from operating activities less net cash flow used in investing activities (see footnote 7). | |

| 9) | Number of doors: number of elevator doors (units), including door mechanisms sold in the period. | |

| 10) | Employees: headcount (full and part-time employees at the end of period). | |

| 11) | Wittur Group Net Financial Debt: 3rd party short and long term borrowings including finance leases less cash and cash equivalents. | |

| 12) | LTM EBITDA Adjusted is EBITDA Adjusted for the twelve months ended September 30, 2018 and December 31, 2017 respectively. LTM EBITDA Adjusted for the period ended September 30, 2018 includes €1.3 million IFRS 16 add-backs for the fourth quarter of 2017 and €3.2 million add-backs for the first three quarters of 2018. LTM EBITDA Adjusted for the twelve months ended December 31, 2017 was not adjusted for IFRS 16. |

|

| 13) | Ratio of Wittur Group Net Financial Debt to Wittur Group LTM EBITDA Adjusted. | |

| 14) | For information on the early adoption of IFRS 16 Leases, please refer to Section “Accounting Policies” in the Nine-Month Financial Report as of September 30, 2018. | |

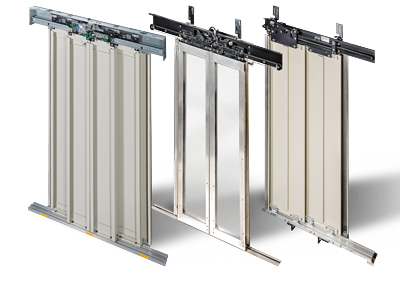

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors. Since 1977 Wittur has been providing the lift industry with versatile and high-quality doors. More than 30 years later Wittur is the leading company in the lift doors segment, with state-of-the-art technical solutions and unparalleled product range. Regardless of whatever your lift requires - a round door with panoramic panels rather than a straight or a folding one - Wittur can supply the best solution for your needs.

Since 1977 Wittur has been providing the lift industry with versatile and high-quality doors. More than 30 years later Wittur is the leading company in the lift doors segment, with state-of-the-art technical solutions and unparalleled product range. Regardless of whatever your lift requires - a round door with panoramic panels rather than a straight or a folding one - Wittur can supply the best solution for your needs. Research for innovative solutions and rigid control of product quality are key features of Wittur Safeties.

Research for innovative solutions and rigid control of product quality are key features of Wittur Safeties.  Wittur offers a wide range of car and counterweight frames. Modularly conceived, these components are very flexible in terms of rated load, height and width. The wide range of accessories includes safety gears, suspension pulleys, compensation chain and travelling cable hangers, allowing configurations suitable for different shaft layouts, lift designs and rated speeds. Wittur can also supply special frames for tailored projects.

Wittur offers a wide range of car and counterweight frames. Modularly conceived, these components are very flexible in terms of rated load, height and width. The wide range of accessories includes safety gears, suspension pulleys, compensation chain and travelling cable hangers, allowing configurations suitable for different shaft layouts, lift designs and rated speeds. Wittur can also supply special frames for tailored projects.

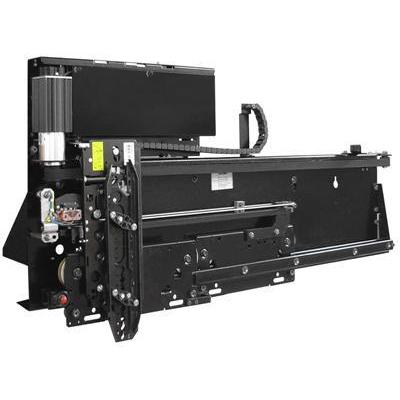

Research for innovative solutions and rigid product quality control are key features of Wittur Safeties.

Research for innovative solutions and rigid product quality control are key features of Wittur Safeties. According to EN81-1/2 A3 and EN81-21 A1 (new lifts in existing buildings), new lifts installed after January 1st 2012 must be equipped with a system to prevent a car moving away from the floor with the landing door not in the locked position and the car door not in the closed position.

According to EN81-1/2 A3 and EN81-21 A1 (new lifts in existing buildings), new lifts installed after January 1st 2012 must be equipped with a system to prevent a car moving away from the floor with the landing door not in the locked position and the car door not in the closed position.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors..jpg) Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors. Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.