March 28, 2018: Consolidated Wittur Group with clear revenue and earnings growth in 2017

Consolidated Wittur Group with clear revenue and earnings growth in 2017

Wiedenzhausen, March 28, 2018 – Wittur Group (ISIN: XS1188024548, XS1188025438) continues to show a strong increase with recorded consolidated revenues of EUR 776.8 million for the twelve months of 2017 which is an increase of 11.3% over the prior year period (12M 2016: EUR 697.8 million).

The strong growth remains a result of both, the Sematic acquisition and an organic growth, which leads to a revenue increase of 8.7% on a pro forma basis excluding FX effects and assuming the Sematic acquisition has occurred on January 1, 2016.

Wittur’s European business contributed 54.2% or EUR 420.8 million to Group revenue in the twelve months of 2017 and continues a growth path by an increase of 15.8% over prior year’s figure of EUR 363.4 million. Good performance is well distributed throughout Europe where our business units in Italy, Spain, Hungary and Austria, amongst others, generated strong growth.

Asian operations generated EUR 286.5 million or 36.9% of revenue in the period under review, up 4.4% over the previous year’s figure of EUR 274.5 million with a strong growth in Asia Pacific including India and a moderate revenue increase in China.

The Rest of World region showed a revenue increase of 16.0% to EUR 69.4 million in the twelve months 2017 (12M 2016: EUR 59.8 million) with a strong contribution to revenue growth in Turkey and in Americas.

Earnings before interest, taxes, depreciation and amortization before exceptional items (EBITDA Adjusted) of the Wittur Group increased by 9.0% to EUR 106.7 million in the period under review (prior year: EUR 97.8 million). This development was mainly influenced by the underlying revenue growth and the generation of synergies following the Sematic acquisition. The EBITDA Adjusted margin was 13.7%.

One-off costs in 2017 are EUR 27.7 million over prior year, mainly due to higher extraordinary items related to the ERP roll-out in Europe including accrued penalties due to delayed deliveries after roll out as well as one-off costs related to the reorganization of business operations.

Net cash flow before financing activities in the twelve months of 2017 of Wittur Group was EUR 67.7 million, an increase of 67.4% over prior year. Wittur Group’s net financial debt improved from EUR 649.7 million on December 31, 2016 to EUR 636.5 million on December 31, 2017. The corresponding leverage ratio, calculated as net financial debt to LTM EBITDA Adjusted, was 5.97x, an improvement of 0.43 turns on a pro forma basis.

The financial information in this press release is based on audited financial figures of the consolidated Wittur Group, except for non-GAAP financial measures such as EBITDA Adjusted. Prior year figures include Sematic financials from April 1, 2016, the date of the acquisition, onwards, unless otherwise specified.

The Annual Report 2017 of Wittur Group will be published on March 28, 2018. A conference call for investors and analysts will take place on the same day at 2 p.m. CEST.

Dial-in numbers & Personal PIN code:

Participants must please register online under this link to receive the dial-in numbers and their personal PIN code.

The online slide presentation will be shown in sync under this weblink.

Please note that the investor relation contact changed.

Your new contact will be Roman Istanbuli, the Corporate Director Financing, Treasury & Investor Relations at Wittur Group.

About Wittur

Founded in 1968, Wittur is one of the world’s leading independent elevator components manufacturers with an extensive global manufacturing footprint and sales network and a broad range of products. Its product offering features a large range of components for new elevator manufacturing and sourcing, for spare parts and for modernization and upgrades. Components made by Wittur span from sophisticated mechatronic components for elevator cabin and landing doors (including the associated opening mechanisms) to other critical components such as gearless drives, slings, safety gears and cars.

In 2016, Wittur further expanded its global reach and its portfolio with the acquisition of the Sematic Group. Sematic S.p.A. and its subsidiaries, an Italian group founded in 1959, added a complementary product offering including complete elevator solutions, highly customised doors, electronic components and cabins. Installation of elevators and maintenance services are not part of the business. The Wittur Group has a work force of around 4,400 employees and conducts business in more than 50 countries. It is majority owned by funds managed by Bain Capital.

For more information on the company, please visit www.wittur.com.

Contacts

Roman Istanbuli

Corporate Director Financing, Treasury & Investor Relations

Wittur Holding GmbH

Rohrbachstraße 26-30

85259 Wiedenzhausen | Germany

Phone: +49(81 34) 18 - 136

Mail: roman.istanbuli@wittur.com

Christoph Kaml

CFO Wittur Group

Wittur Holding GmbH

Rohrbachstraße 26-30

85259 Wiedenzhausen | Germany

Phone: +49(81 34) 18 - 101

Mail: christoph.kaml@wittur.com

- Wittur Group 12M 2017 consolidated revenues increased by 11.3% to EUR 776.8 million

- Strong underlying pro-forma revenue growth at constant currency of 8.7%

- Consolidated EBITDA Adjusted increased by 9.0% to EUR 106.7 million

- Net cash flow before financing activities up by 67.4% to EUR 67.7 million

- Leverage ratio improved by 0.43 turns to 5.97x with reduced net financial debt of EUR 636.5 million at year end 2017

Wiedenzhausen, March 28, 2018 – Wittur Group (ISIN: XS1188024548, XS1188025438) continues to show a strong increase with recorded consolidated revenues of EUR 776.8 million for the twelve months of 2017 which is an increase of 11.3% over the prior year period (12M 2016: EUR 697.8 million).

The strong growth remains a result of both, the Sematic acquisition and an organic growth, which leads to a revenue increase of 8.7% on a pro forma basis excluding FX effects and assuming the Sematic acquisition has occurred on January 1, 2016.

Wittur’s European business contributed 54.2% or EUR 420.8 million to Group revenue in the twelve months of 2017 and continues a growth path by an increase of 15.8% over prior year’s figure of EUR 363.4 million. Good performance is well distributed throughout Europe where our business units in Italy, Spain, Hungary and Austria, amongst others, generated strong growth.

Asian operations generated EUR 286.5 million or 36.9% of revenue in the period under review, up 4.4% over the previous year’s figure of EUR 274.5 million with a strong growth in Asia Pacific including India and a moderate revenue increase in China.

The Rest of World region showed a revenue increase of 16.0% to EUR 69.4 million in the twelve months 2017 (12M 2016: EUR 59.8 million) with a strong contribution to revenue growth in Turkey and in Americas.

Earnings before interest, taxes, depreciation and amortization before exceptional items (EBITDA Adjusted) of the Wittur Group increased by 9.0% to EUR 106.7 million in the period under review (prior year: EUR 97.8 million). This development was mainly influenced by the underlying revenue growth and the generation of synergies following the Sematic acquisition. The EBITDA Adjusted margin was 13.7%.

One-off costs in 2017 are EUR 27.7 million over prior year, mainly due to higher extraordinary items related to the ERP roll-out in Europe including accrued penalties due to delayed deliveries after roll out as well as one-off costs related to the reorganization of business operations.

Net cash flow before financing activities in the twelve months of 2017 of Wittur Group was EUR 67.7 million, an increase of 67.4% over prior year. Wittur Group’s net financial debt improved from EUR 649.7 million on December 31, 2016 to EUR 636.5 million on December 31, 2017. The corresponding leverage ratio, calculated as net financial debt to LTM EBITDA Adjusted, was 5.97x, an improvement of 0.43 turns on a pro forma basis.

The financial information in this press release is based on audited financial figures of the consolidated Wittur Group, except for non-GAAP financial measures such as EBITDA Adjusted. Prior year figures include Sematic financials from April 1, 2016, the date of the acquisition, onwards, unless otherwise specified.

The Annual Report 2017 of Wittur Group will be published on March 28, 2018. A conference call for investors and analysts will take place on the same day at 2 p.m. CEST.

Dial-in numbers & Personal PIN code:

Participants must please register online under this link to receive the dial-in numbers and their personal PIN code.

The online slide presentation will be shown in sync under this weblink.

Please note that the investor relation contact changed.

Your new contact will be Roman Istanbuli, the Corporate Director Financing, Treasury & Investor Relations at Wittur Group.

About Wittur

Founded in 1968, Wittur is one of the world’s leading independent elevator components manufacturers with an extensive global manufacturing footprint and sales network and a broad range of products. Its product offering features a large range of components for new elevator manufacturing and sourcing, for spare parts and for modernization and upgrades. Components made by Wittur span from sophisticated mechatronic components for elevator cabin and landing doors (including the associated opening mechanisms) to other critical components such as gearless drives, slings, safety gears and cars.

In 2016, Wittur further expanded its global reach and its portfolio with the acquisition of the Sematic Group. Sematic S.p.A. and its subsidiaries, an Italian group founded in 1959, added a complementary product offering including complete elevator solutions, highly customised doors, electronic components and cabins. Installation of elevators and maintenance services are not part of the business. The Wittur Group has a work force of around 4,400 employees and conducts business in more than 50 countries. It is majority owned by funds managed by Bain Capital.

For more information on the company, please visit www.wittur.com.

Contacts

Roman Istanbuli

Corporate Director Financing, Treasury & Investor Relations

Wittur Holding GmbH

Rohrbachstraße 26-30

85259 Wiedenzhausen | Germany

Phone: +49(81 34) 18 - 136

Mail: roman.istanbuli@wittur.com

Christoph Kaml

CFO Wittur Group

Wittur Holding GmbH

Rohrbachstraße 26-30

85259 Wiedenzhausen | Germany

Phone: +49(81 34) 18 - 101

Mail: christoph.kaml@wittur.com

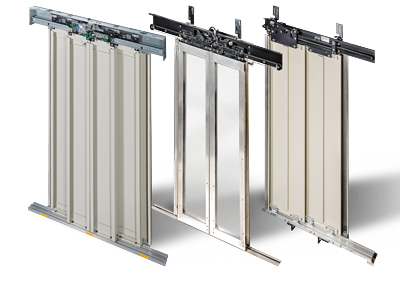

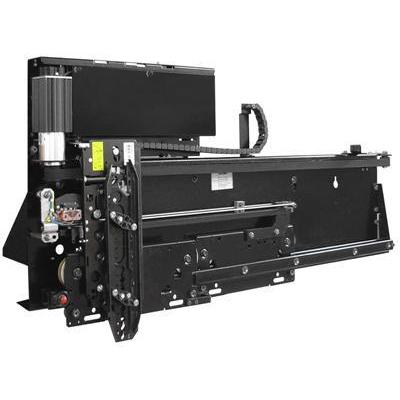

自1977年来,威特就开始为电梯行业提供多功能、高品质的轿厢门。设计灵活,加上通过了一系列认证,使威特层门能够适应各种应用。有多种表面装饰和规格,因此能适合各种环境:从住宅到高档写字楼、从外部设施到豪华的水上项目、从工业建筑到医院。

自1977年来,威特就开始为电梯行业提供多功能、高品质的轿厢门。设计灵活,加上通过了一系列认证,使威特层门能够适应各种应用。有多种表面装饰和规格,因此能适合各种环境:从住宅到高档写字楼、从外部设施到豪华的水上项目、从工业建筑到医院。 Since 1977 Wittur has been providing the lift industry with versatile and high-quality doors. More than 30 years later Wittur is the leading company in the lift doors segment, with state-of-the-art technical solutions and unparalleled product range. Regardless of whatever your lift requires - a round door with panoramic panels rather than a straight or a folding one - Wittur can supply the best solution for your needs.

Since 1977 Wittur has been providing the lift industry with versatile and high-quality doors. More than 30 years later Wittur is the leading company in the lift doors segment, with state-of-the-art technical solutions and unparalleled product range. Regardless of whatever your lift requires - a round door with panoramic panels rather than a straight or a folding one - Wittur can supply the best solution for your needs.

Wittur offers a wide range of car and counterweight frames. Modularly conceived, these components are very flexible in terms of rated load, height and width. The wide range of accessories includes safety gears, suspension pulleys, compensation chain and travelling cable hangers, allowing configurations suitable for different shaft layouts, lift designs and rated speeds. Wittur can also supply special frames for tailored projects.

Wittur offers a wide range of car and counterweight frames. Modularly conceived, these components are very flexible in terms of rated load, height and width. The wide range of accessories includes safety gears, suspension pulleys, compensation chain and travelling cable hangers, allowing configurations suitable for different shaft layouts, lift designs and rated speeds. Wittur can also supply special frames for tailored projects.

创新的解决方案研究和严格的产品质量控制是威特安全部件的主要特色。产品系列包括不定向/双向同步和渐进式安全钳。也可提供上升轿厢超速保护装置。

创新的解决方案研究和严格的产品质量控制是威特安全部件的主要特色。产品系列包括不定向/双向同步和渐进式安全钳。也可提供上升轿厢超速保护装置。 According to EN81-1/2 A3 and EN81-21 A1 (new lifts in existing buildings), new lifts installed after January 1st 2012 must be equipped with a system to prevent a car moving away from the floor with the landing door not in the locked position and the car door not in the closed position.

According to EN81-1/2 A3 and EN81-21 A1 (new lifts in existing buildings), new lifts installed after January 1st 2012 must be equipped with a system to prevent a car moving away from the floor with the landing door not in the locked position and the car door not in the closed position. 所有井道附件对于保证电梯的正常运行和使用寿命都是至关重要的。这正是威特提供以下各种附件的原因:

所有井道附件对于保证电梯的正常运行和使用寿命都是至关重要的。这正是威特提供以下各种附件的原因:

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors..jpg) Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors. Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.

Since 1977 Wittur supplies the lift industry with versatile and high-quality doors.